Solutions for Different Financial Sectors

CE Loan SMB

Make your online lending process for small and medium businesses agile. We provide white-label system for end users and back office to support throughout the lending process.

CE Loan Enterprise

Digitalize your bank’s loan operations. We support efficient communications between you and your customers and minimalize analog procedures and paperworks traditionally required.

CE Loan Personal

Provide a simple and smooth online lending experience to your consumers. We pair our automated lending process with a web-oriented, user-friendly lending system.

CE Factoring

Automate your online factoring. We support all kinds of invoice factoring and invoice financing services.

CE POS Financing

Improve your consumer’s online purchases experiences. We provide an agile platform tailored for retailers and service providers.

CE Leasing

Centralize your leasing procedures in a fully integrated, end-to-end leasing platform. We support leases in sectors including automobile and consumer goods.

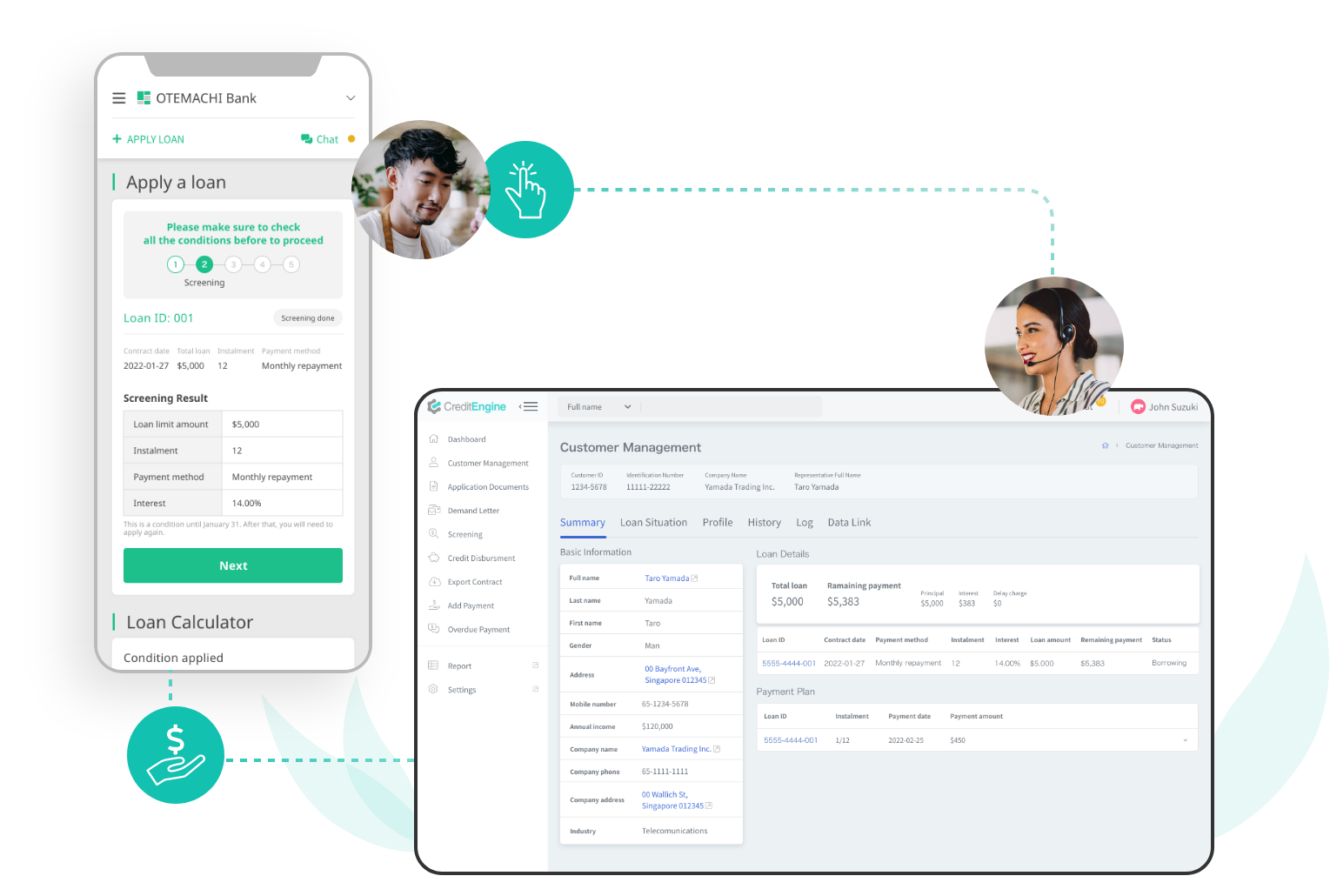

Covering the entire Online Lending Process

1. End user Application

- - Web-oriented, mobile friendly interface

- - White labeled front-end system to be tailored for your brand

2. Application Processing

- - Paperless process

- - eKYC verification process

3. Screening

- - Real-time scoring model with online data

- - Connected with existing or third-party model

- - Integrated with external DC of AML, credit bureaus and more

4. Contracting /Execution

- - Streamlined online contract process

- - Electronic signature

- - Third-party provider integration

5. Contract Managing

- - Credit disbursement and repayment management

- - Payment schedules calculations and trackings

- - Payment confirmation connected with internal/external system

6. End user Repayment

- - Automated e-mail/SMS reminder

- - Repayment schedules reconstructions

SaaS Lending

White-label solution for your end users and manage your entire online lending process with our back office system, customizable with over 200 settings.

Back office

- - All lending transactions’ progress status in clear view

- - Lending management and report features

- - Integration with your internal/3rd party systems available

- - Operable by a small team

End user

- - Seamless lending experience

- - One-stop process from application to repayment

- - eKYC user verification

- - Online chat support

More Advanced Features

Report Generation

Customize your reports based on SQL queries. We capture key indicators and critical data for your easy analysis.

Chat System

Communicate with your users in real time. We log all your messages automatically in the cloud.

API Integration

Export your loan execution, repayment and other critical data in a few steps with API integration.

CE Credit Scoring

Base your scoring model on online data. We offer customization to your requirements and integration with existing or third-party model.

Customizable Decision Procedure

Fully automate your approval process. We offer optional settings to create an approval flow customized with approvers and deadlines.

Cloud-based Platform

We provide our cloud-based technology meeting high security and operational standards with a short development timeframe. Updates and new features are also implemented regularly.

Trusted by World-Leading Clients

News & More

Lending April 8, 2022Top guarantor service company for housing loans “ZENKOKU HOSHO” choose Credit Engine as an online platform for application

Lending April 8, 2022Top guarantor service company for housing loans “ZENKOKU HOSHO” choose Credit Engine as an online platform for application Lending December 13, 2021Hiroshima Bank choose Credit Engine's SaaS Lending "CE Loan SMB" as their Online Loan Service for SMB

Lending December 13, 2021Hiroshima Bank choose Credit Engine's SaaS Lending "CE Loan SMB" as their Online Loan Service for SMB Lending August 31, 2021Credit Engine begins providing "CE Loan" to USEN-NEXT GROUP's financial business

Lending August 31, 2021Credit Engine begins providing "CE Loan" to USEN-NEXT GROUP's financial business